Last updated on May 3, 2023

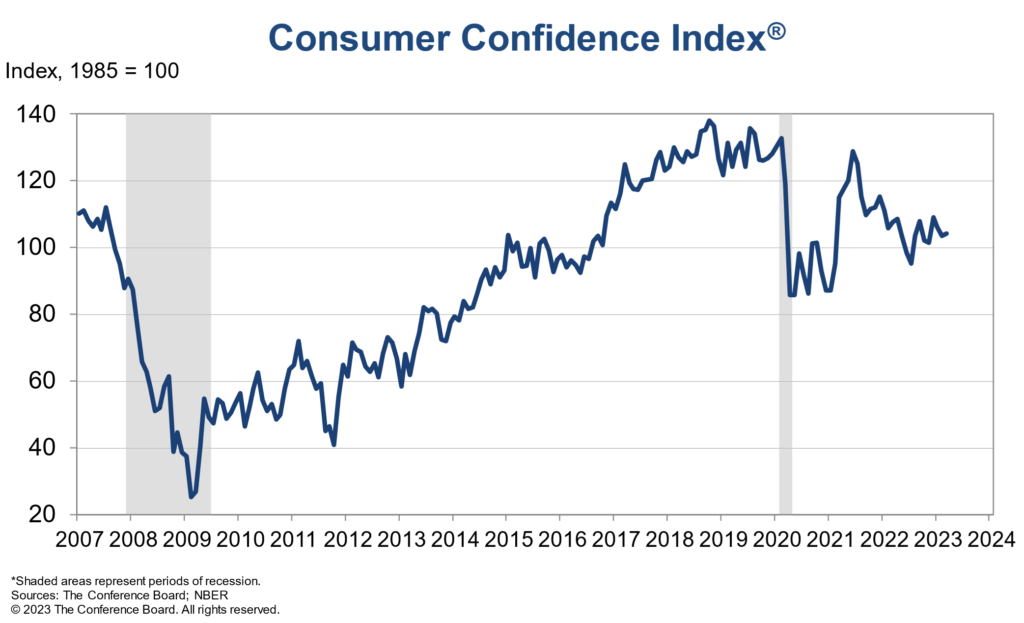

Consumers are exhibiting confidence despite the challenging market conditions with interest rates gradually rising and markets struggling to stabilize. The March Consumer Confidence Index was stronger than expected, recording 104.2 compared to February 2023’s 103.4. The estimate was for 100.7.

However, the Expectations Index has remained below 80 for most of the previous 13 months, which is an indication of a possible recession.

Despite the banking crisis, consumers remain optimistic about their future, which is causing inflation and mounting pressure on interest rates. The market anticipates higher interest rates and a decline in the stock market as a result. Most indicators point to significant inflation levels, with the market pricing in a 6.3% increase over the next year. As a result, the Federal Reserve is expected to raise rates, which will exacerbate the economic weakness and result in a poor to flat stock market. As mentioned previously, the market is preparing itself for higher rates.

Here are a few links with explanations-

For comments or feedback email us info@fiscalinvestor.com

Be First to Comment