Despite last week’s sell-off, the market has been on an incredible run, with the S&P showing a year-to-date gain of approximately 16.63% as of August 4, 2023. While it experienced its worst week since March 2023, the overall upward trend has been remarkable. As Fiscal Investors, it’s essential to remain level-headed and focused on quality and value during these times.

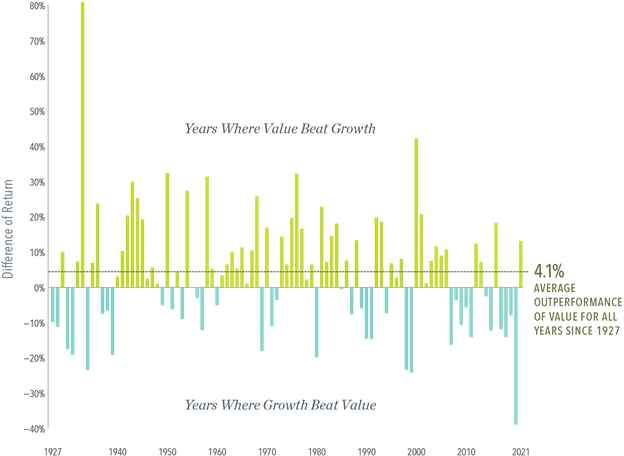

In this stock-pickers market, conducting thorough research is crucial. Resist the temptation to follow the stock of the day or week, and instead, invest with a long-term perspective. While there are exciting growth opportunities, historical evidence suggests that value tends to outperform the market in the long run. One should be aware that the returns of growth recently were in periods of low interest rates!

Figure 1: Credit https://www.dimensional.com/us-en/insights/when-its-value-versus-growth-history-is-on-values-side

Several factors point to bullish sentiments. A significant percentage of S&P 500 companies (over 85%) have reported, and 80% of them have exceeded estimates, reflecting strong corporate performance. Favorable jobs data, decreasing inflation, and signals of potentially slowing rate hikes from the Federal Reserve add to the positive outlook for Fiscal Investors.

Although market performance fluctuates, a commitment to quality investments over the long run can instill confidence in fiscal investors. Avoid getting swayed by short-term trends or fads and instead seek companies with solid earnings growth and manageable debt.

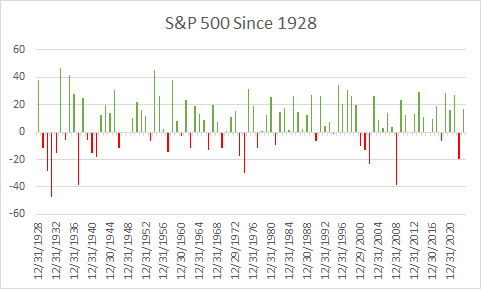

As demonstrated in the chart below, the market has shown positive performance over the last 50 years, although not without periods of negativity. It’s worth noting that the impact of value versus growth stocks varies depending on market dynamics and economic cycles. Value investors seek undervalued stocks that the market has overlooked, while growth investors focus on companies with promising revenue and earnings growth potential. The market average over the last 50 years has been around 7.78%. However, you can see we often have market rallies between downturns as confidence returns. A Fiscal Investor always should practice risk management.

Understanding market dynamics, such as economic cycles and investor sentiment, is crucial in comprehending the relative performance of value and growth stocks. Additionally, interest rates and inflation can play a significant role in influencing the attractiveness of each style. Low interest rates favor growth stocks, while rising rates may make value stocks more appealing.

Remember, past performance does not guarantee future results. Successful investing requires careful consideration of individual goals, risk tolerance, and time horizon. Seeking advice from financial professionals and conducting thorough research can help make informed investment decisions in this ever-changing market landscape.”