Consumer spending is the engine of the economy. It accounts for 70% of GDP, and when consumers spend, businesses thrive. However, consumers are only going to spend if they have jobs. This is why job creation is so important. It is the only thing that matters in the economy right now.

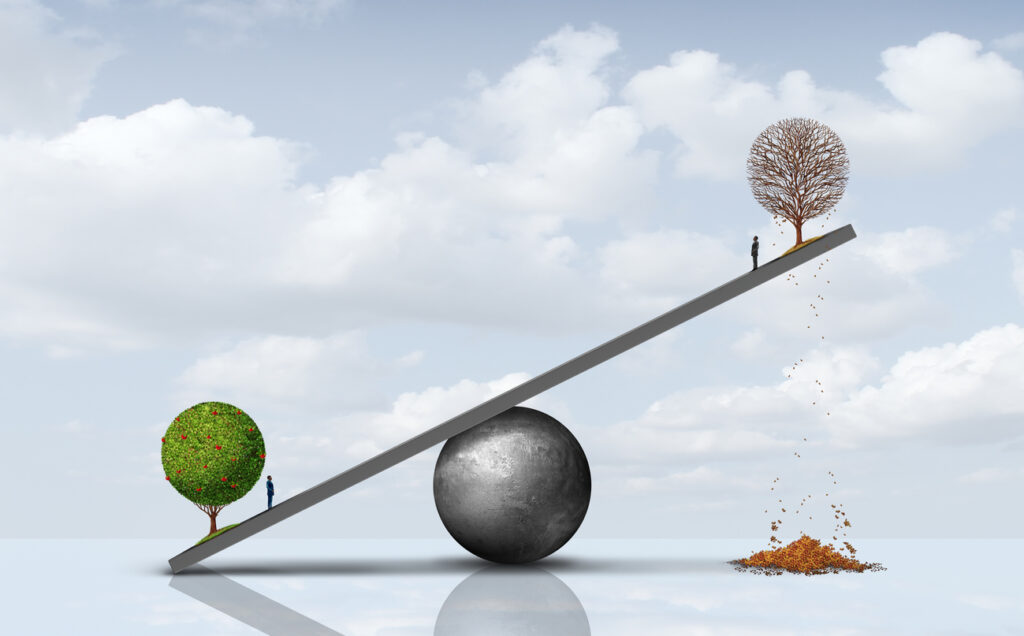

Interest rates will have an impact on the market and it will slow the economy. This is because higher interest rates make it more expensive to borrow money, which can dampen demand for goods and services. However, as long as we have a tight labor market, things will be okay.

Strikes are happening because businesses see the slowdown but workers feel inflation. Inflation is eroding workers’ wages, so they are demanding higher pay. Businesses are reluctant to give in to these demands, as they are facing their own challenges due to the slowdown.

There will be a middle ground. Businesses and workers will need to come together to find a solution that works for everyone. This may involve some give and take on both sides.

In the meantime, investors should be patient. The economy is going through a period of adjustment, but it will eventually find its footing. In the long run, the US economy is still the strongest in the world.

Recommendations:

- Invest in companies that are well-positioned to weather the storm. These companies should have strong balance sheets, pricing power, and a loyal customer base.

- Focus on dividend-paying companies. Dividends provide a steady stream of income, which can help to offset volatility in the stock market.

- Be patient and don’t panic sell. The market will eventually recover.

Be First to Comment